Company ABC is planning to bid for company DDD, an unlisted company in an unrelated industry sector to ABC.

The directors of ABC are considering a number of different valuation methods for DDD before making a bid.

Which of the following is the MOST appropriate method for ABC to use to value DDD?

PPP's home currency is the PS. An overseas customer is due to make a payment of A$5,000,000 to PPP in 3 months. The present spot rate is 1PS = 5A$. P can obtain an interest rate of 4% per year on P$ deposits and 6% per year on AS deposits.

Forecast the value of the customer's payment to PPP, in PS, when the payment is made in 3 months' time.

Give your answer to the nearest thousand P$.

Company A has just announced a takeover bid for Company B. The two companies are large companies in the same industry_ The bid is considered to be hostile.

Company B's Board of Directors intends to try to prevent the takeover as they do not consider it to be in the best interests of shareholders

Which THREE of the following are considered to be legitimate post-offer defences?

A company's gearing is well below its optimal level and therefore it is considering implementing a share re-purchase programme.

This programme will be funded from the proceeds of a planned new long-term bond issue.

Its financial projections show no change to next year's expected earnings.

As a result, the company plans to pay the same total dividend in future years.

If the share re-purchase is implemented, which THREE of the following measures are most likely to decrease?

A listed company with a growing share price plans to finance a four-year research project with debt.

The main criterion for the finance is to minimise the annual cashflow payments on the debt.

The research will be sold at the end of the project.

Which of the following would be the most suitable financing method for the company?

A listed entertainment and media company produces and distributes films globally. The company invests heavily in intellectual property in order to create the scope for future film projects. The company has five separate distribution companies, each managed as a separate business unit The company is seeking to sell one of its business units in a management buy-out (MBO) to enable it to raise finance for proposed new investments

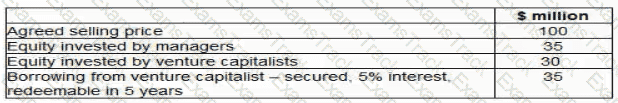

The business unit managers have been in discussions with a bank and venture capitalists regarding the financing for the MBO The venture capitalists are only prepared to invest a mixture of debt and equity and have suggested the following:

The venture capitalists have stated that they expect a minimum return on their equity investment of 3Q°/o a year on a compound basis over the first 5 years of the MBO No dividends will be paid during this period.

Advise the MBO team of the total amount due to the venture capitalist over the 5-year period to satisfy their total minimum return?

A company is considering whether to lease or buy an asset.

The following data applies:

• The bank will charge interest at 7.14% per annum

• The asset will cost $1 million

• Tax-allowable depreciation is available on a straight line basis over 5 years

• There is no residual value

• Corporate tax is paid at 30% in the year when the profit is earned

What is the NPV of the buy option?

Give your answer to the nearest $000.

$ ?

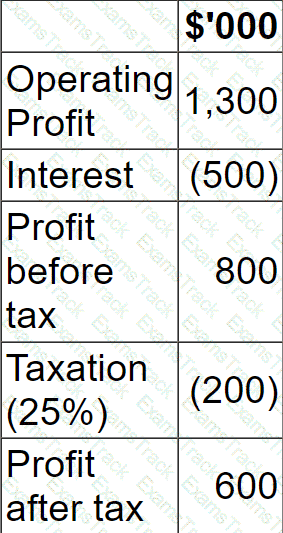

A company has forecast the following results for the next financial year:

The following is also relevant:

• Profit after tax for the year can be assumed to be equivalent to free cash flow for the year.

• Debt finance comprises a $10 million floating rate loan which currently carries an interest rate of 5%.

• $400,000 investment in non-current assets is required to achieve required growth, all of which is to financed from next year's free cash flow.

• The company plans to pay a dividend of $150,000 next year, financed from next year's free cash flow.

The company is concerned that interest rates could rise next year to 6% which could then affect their investment plans.

If interest rates were to rise to 6% and the company wishes to maintain its dividend amount, the planned investment expenditure will decrease by:

A company plans to raise $12 million to finance an expansion project using a rights issue.

Relevant data:

• Shares will be offered at a 20% discount to the present market price of $15.00 per share.

• There are currently 2 million shares in issue.

• The project is forecast to yield a positive NPV of $6 million.

What is the yield-adjusted Theoretical Ex-Rights Price following the announcement of the rights issue?

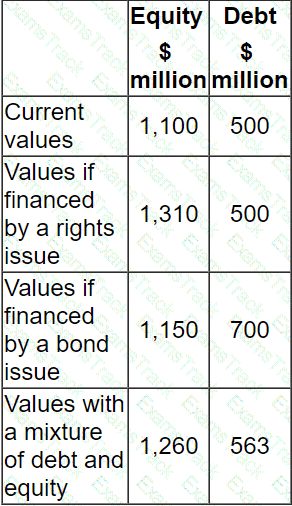

A company is financed by debt and equity and pays corporate income tax at 20%.

Its main objective is the maximisation of shareholder wealth.

It needs to raise $200 million to undertake a project with a positive NPV of $10 million.

The company is considering three options:

• A rights issue.

• A bond issue.

• A combination of both at the current debt to equity ratio.

Estimations of the market values of debt and equity both before and after the adoption of the project have been calculated, based upon Modigliani and Miller's capital theory with tax, and are shown below:

Under Modigliani and Miller's capital theory with tax, what is the increase in shareholder wealth?

|

PDF + Testing Engine

|

|---|

|

$74.7 |

|

Testing Engine

|

|---|

|

$67.5 |

|

PDF (Q&A)

|

|---|

|

$59.7 |

CIMA Free Exams |

|---|

|