Which THREE of the following would be most important if a hospital wishes to review the effectiveness of its services?

An all equity financed company reported earnings for the year ending 31 December 20X1 of $5 million.

One of its financial objectives is to increase earnings by 5% each year.

In the year ending 31 December 20X2 it financed a project by issuing a bond with a $1 million nominal value and a coupon rate of 7%.

The company pays corporate income tax at 30%.

If the company is to achieve its earnings target for the year ending 31 December 20X2, what is the minimum operating profit (profit before interest and tax) that it must achieve?

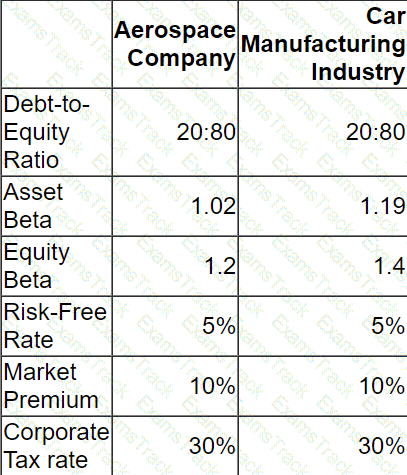

An aerospace company is planning to diversify into car manufacturing.

Relevant data:

What is the the cost of equity to be used in the WACC for the project appraisal?

Give your answer in percentage, as a whole number.

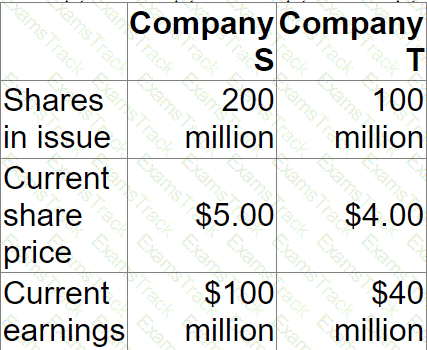

Company S is planning to acquire Company T.

The shareholders in Company T will receive new shares in Company S in an all-share consideration.

Relevant information:

The shareholders in Company T want sufficient shares to receive a 25% premium on the pre-acquisition value of their shares, based on the pre-acquisition share price.

Which of the following share-for-share offers will achieve the desired result?

Under traditional theory, an increase in a company's WACC would cause the value of the company to:

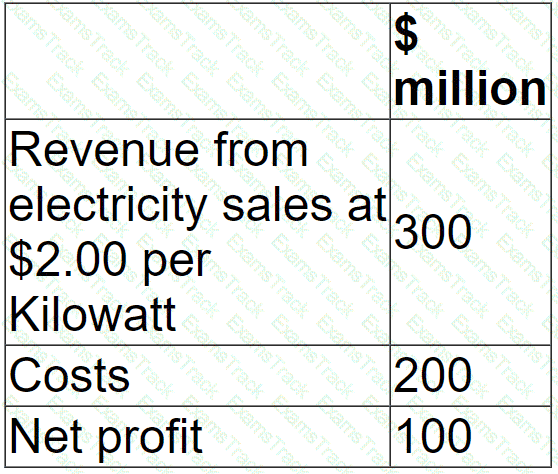

A company generates and distributes electricity and gas to households and businesses.

Forecast results for the next financial year are as follows:

The Industry Regulator has announced a new price cap of $1.50 per Kilowatt.

The company expects this to cause consumption to rise by 10% but costs would remained unaltered.

The price cap is expected to cause the company's net profit to fall to:

A company is owned by its five directors who want to sell the business.

Current profit after tax is $750,000.

The directors are currently paid minimal salaries, taking most of their incomes as dividends.

After the company is sold, directors' salaries will need to be increased by $50,000 each year in total.

A suitable Price/Earnings (P/E) ratio is 7, and the rate of corporate tax is 20%.

What is the value of the company using a P/E valuation?

Which THREE of the following statements are correct in respect of the issuance of debt securities.

Company A has a cash surplus.

The discount rate used for a typical project is the company's weighted average cost of capital of 10%.

No investment projects will be available for at least 2 years.

Which of the following is currently most likely to increase shareholder wealth in respect of the surplus cash?

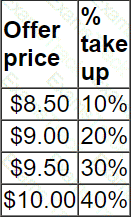

A listed company is planning a share repurchase.

Research into different offer prices has given the following data with regards acceptance by the shareholders at different prices:

What price should be offered to shareholders if the retained earnings of the company are to remain unchanged?

|

PDF + Testing Engine

|

|---|

|

$74.7 |

|

Testing Engine

|

|---|

|

$67.5 |

|

PDF (Q&A)

|

|---|

|

$59.7 |

CIMA Free Exams |

|---|

|