In the context of the Integrated Reporting

Which THREE of the following methods of business valuation would give a valuation of the equity of an entity, rather than the value of the whole entity?

A company has announced a rights issue of 1 new share for every 4 existing shares.

Relevant data:

• The current market price per share is $10.00.

• Rights are to be issued at a 20% discount to the current price.

• The rate of return on the new funds raised is expected to be 10%.

• The rate of return on existing funds is 5%.

What is the yield-adjusted theoretical ex-rights price?

Give your answer to two decimal places.

$ ?

A company with a market capitalisation of S50million is considering raising $1 million debt to fund a new 10-year capital investment protect

The value of this issue is considered to be small in comparison to the company's market capitalisation

The company is considering whether to raise the debt finance by either a "bond private placing' or a 'public bond issue.

Which THREE of the following statements are correct?

A company raised fixed rate bank finance together with an interest rate swap for the same term and same principal value to pay floating receive fixed rate interest on an annual basis.

Which THREE of the following statements are correct?

A listed company follows a policy of paying a constant dividend. The following information is available:

• Issued share capital (nominal value $0.50) $60 million

• Current market capitalisation $480 million

The shareholders are requesting an increased dividend this year as earnings have been growing. However, the directors wish to retain as much cash as possible to fund new investments. They therefore plan to announce a 1-for-10 scrip dividend to replace the usual cash dividend.

Assuming no other influence on share price, what is the expected share price following the scrip dividend?

Give your answer to 2 decimal places.

$ ?

Company A needs to raise AS500 mi lion to invest in a new project and is considering using a pub ic issue of bonds to finance the investment.

Which THREE of the following statements-relating to this bond issue are true?

Company Z wishes to borrow $50 million for 10 years at a fixed rate of interest.

Two alternative approaches are being considered:

A. Issue a 10 year bond at a fixed rate of 6%, or

B. Borrow from the bank at Libor +2.5% for a 10 year period and simultaneously enter into a 10 year interest rate swap.

Current 10 year swap rates against Libor are 4.0% - 4.2%.

What is the difference in the net interest cost between the two alternative approaches?

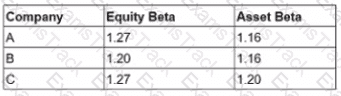

Three companies are quoted on the New York Stock Exchange. The following data applies:

Which of the following statements is TRUE?

A UK company enters into a 5 year borrowing with bank P at a floating rate of GBP Libor plus 3%

It simultaneously enters into an interest rate swap with bank Q at 4.5% fixed against GBP Libor plus 1.5%

What is the hedged borrowing rate, taking the borrowing and swap into account?

Give your answer to 1 decimal place.

|

PDF + Testing Engine

|

|---|

|

$74.7 |

|

Testing Engine

|

|---|

|

$67.5 |

|

PDF (Q&A)

|

|---|

|

$59.7 |

CIMA Free Exams |

|---|

|