The primary objective of a public sector entity is to ensure value for money is generated.

Value for money is defined as performing an activity so as to simultaneously achieve economy, efficiency and effectiveness

Efficiency is defined as:

Which THREE of the following are considered in detail in IFRS 7 Financial Instruments: Disclosures?

Providers of debt finance often insist on covenants being entered into when providing debt finance for companies.

Agreement and adherence to the specific covenants is often a condition of the loan provided by the lender.

Which THREE of the following statements are true in respect of covenants?

A company has a loss-making division that it has decided to divest in order to raise cash for other parts of the business.

The losses stem from a combination of a lack of capital investment and poor divisional management.

The loss-making division would require new capital investment of at least $20 million in order to replace worn out and obsolete assets.

If this investment was carried out, the present value of the future cashflows, excluding the investment expenditure, is expected to be $15 million.

Which TWO of the following divestment methods are most likely to be suitable for the company?

A company is considering either exporting its product directly to customers in a foreign country or establishing a manufacturing subsidiary in that country.

The corporate tax rate in the company's own country is 20% and 25% tax depreciation allowances are available.

Which THREE of the following would be considered advantages of establishing the subsidiary in the foreign country?

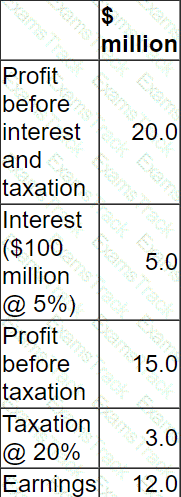

A company has in a 5% corporate bond in issue on which there are two loan covenants.

• Interest cover must not fall below 3 times

• Retained earnings for the year must not fall below $3.5 million

The Company has 200 million shares in issue.

The most recent dividend per share was $0.04.

The Company intends increasing dividends by 10% next year.

Financial projections for next year are as follows:

Advise the Board of Directors which of the following will be the status of compliance with the loan covenants next year?

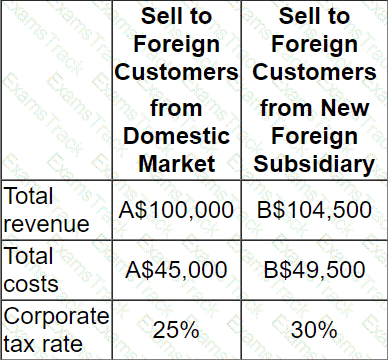

A company is considering either directly exporting its product to customers in a foreign country or setting up a subsidiary in the foreign country to manufacture and supply customers in that country.

Details of each alternative method of supplying the foreign market are as follows:

There is an import tax on product entering the foreign country of 10% of sales value.

This import duty is a tax-allowable deduction in the company's domestic country.

The exchange rate is A$1.00 = B$1.10

Which alternative yields the highest total profit after taxation?

A venture capitalist is most likely to take which THREE of the following exit routes?

A company plans to raise finance for a new project.

It is considering either the issue of a redeemable cumulative preference share or a Eurobond.

Advise the directors which of the following statements would justify the issue of preference shares over a bond?

A Venture Capital Fund currently holds a significant shareholding in a large private company as a result of funding a recent management buyout. It plans to exit this investment in 5 years time at a significant profit.

Which THREE of the following exit mechanisms are most likely to be preferred by the Venture Capital Fund?

|

PDF + Testing Engine

|

|---|

|

$74.7 |

|

Testing Engine

|

|---|

|

$67.5 |

|

PDF (Q&A)

|

|---|

|

$59.7 |

CIMA Free Exams |

|---|

|