Company M plans to bid for Company J. Company M has 20 million shares in issue and a current share price of $10.00 before publicly announcing the planned takeover. Company J has 10 million shares in issue and a current share price of $4.00.

The directors of Company M are considering an all-share bid of 1 Company M shares for 2 Company J shares.

Synergies worth $20m are expected from the acquisition.

What is the likely change in wealth for Company M's shareholders (in total) if the bid is accepted?

Give your answer to the nearest $ million.

$ ? million

The Board of Directors of a listed company wish to estimate a reasonable valuation of the entire share capital of the company in the event of a takeover bid.

The company's current profit before taxation is $10 0 million.

The rate of corporate tax is 20%.

The average P/E multiple of listed companies in the same industry is 10 times current earnings.

The P/E multiple of recent takeovers in the same industry have ranged from 11 times to 12 times current earnings.

The average P/E multiple of the top 100 companies on the stock market is 16 times current earnings.

Advise the Board of Directors which of the following is a reasonable estimate of a range of values of the entire share capital in the event of a bid being made for the whole company?

MAN is a manufacturing company that is based in country M and sells almost exclusively to customers in country M, priced in the local currency, M$.

MAN wishes to expand the business by acquiring a company that manufactures similar products but has a more global customer base. It is particularly interested in selling to customers in country P, which uses currency P$ but recognises that the P$ is generally quite volatile against the M$.

Country P uses the same language as country M, has free entry of labour from country M, no exchange controls or withholding tax and a favourable double tax treaty.

Which of the following companies would be most suitable takeover candidates for MAN to investigate further?

Company RRR is a well-established, unlisted, road freight company.

In recent years RRR has come under pressure to improve its customer service and has had some success in doing this However, the cost of improved service levels has resulted in it making small losses in its latest financial year. This is the first time RRR has not been profitable.

RRR uses a 'residual' dividend policy and has paid dividends twice in the last 10 years.

Which of the following methods would be most appropriate for valuing RRR?

XCV can borrow at either 9.5% fixed or the risk-free rate plus 1.3%.

XCV wishes to borrow at a variable rate and thinks that a swap may enable it to do so cheaply

BNM can borrow the same principal sum as XCV It can borrow at 10 5% fixed or the risk-free rate plus 2 1 % BNM wishes to raise fixed rate debt

XCV and BNM have agreed to use an interest rate swap They will share any savings equally

Calculate the effective swap rate that will be paid by XCV.

Give your answer to one decimal place.

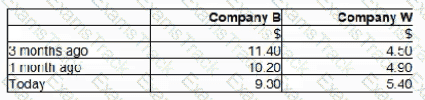

Company W has received an unwelcome takeover bid from Company B. The offer is a share exchange of 3 shares in Company B for 5 shares in Company W or a cash alternative of $5.70 for each Company W share.

Company B is approximately twice the size of Company W based on market capitalisation. Although the two companies have some common business interested the main aim of the bid is diversification for Company B.

Company W has substantial cash balances which the directors were planning to use to fund an acquisition. These plans have not been announced to the market.

The following share price information is relevant.

Which of the following would be the most appropriate action by Company W's directors following receipt of this hostile bid?

A listed company has suffered a period of falling revenues and profit margins. It has been obliged to issue a profit warning to the market and its share price has fallen sharply. The company relies heavily on debt finance and is discussing with its banks possible refinancing options to assist with a restructuring programme.

Which THREE of the following are likely to be of MOST interest to the company's banks when they review the refinancing requests?

Company M is a listed company in a highly technical service industry.

The directors are considering making a cash offer for the shares in Company Q, an unquoted company in the same industry.

Relevant data about Company Q:

• The company has seen consistent growth in earnings each year since it was founded 10 years ago.

• It has relatively few non-current assets.

• Many of the employees are leading experts in their field. A recent exercise suggested that the value of the company's human capital exceeded the value of its tangible assets.

The directors and major shareholders of Company Q have indicated willingness to sell the company.

Before negotiations become too advanced, the directors of Company M are considering the benefits to their company that would follow the acquisition.

Which THREE of the following are the most likely benefits of the acquisition to Company M's shareholders?

Company AAB is located in country A whose currency is the AS It has a subsidiary, BBA, located m country B that has the BS as its currency AAB has asked BBA to pay BS40 million surplus funds to AAB to assist with a planned new capital investment in country A The exchange rate today is AS1 = BS3

Tax regimes

• Company BBA pays withholding tax of 25% on all cash remitted to the parent company

• Company AAB pays tax of 10% on at cash received from its subsidiary

How much will company AAB have available for investment after receiving the surplus funds from BBA?

Z wishes to borrow at a floating rate and has been told that it can use swaps to reduce the effective interest rate it pays. Z can borrow floating at Libor ' 1, and fixed at 10%.

Which of the following companies would be the most appropriate for Z to enter into a swap with?

|

PDF + Testing Engine

|

|---|

|

$74.7 |

|

Testing Engine

|

|---|

|

$67.5 |

|

PDF (Q&A)

|

|---|

|

$59.7 |

CIMA Free Exams |

|---|

|