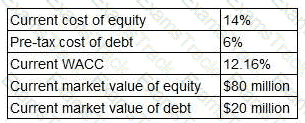

TTT pic is a listed company. The following information is relevant:

TTT pic's board is considering issuing new 6% irredeemable debt to re-purchase equity. This is expected to change TTT pic's debt to equity mix to 40: 60 by market value. The corporate tax rate is 20%.

What will be TTT pic's WACC following this change in capital structure?

A company has 8% convertible bonds in issue. The bonds are convertible in 3 years time at a ratio of 20 ordinary shares per $100 nominal value bond.

Each share:

• has a current market value of $5.60

• is expected to grow at 5% each year

What is the expected conversion value of each $100 nominal value bond in 3 years' time?

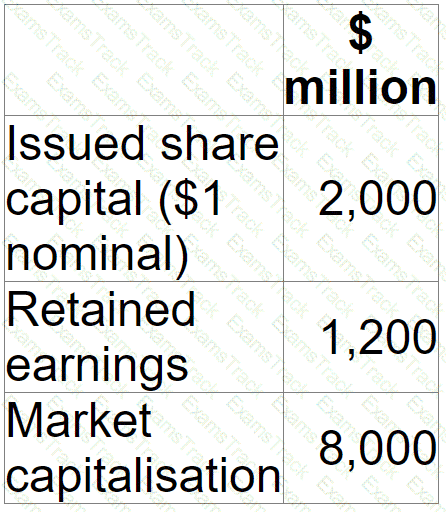

A listed company is financed by debt and equity.

If it increases the proportion of debt in its capital structure it would be in danger of breaching a debt covenant imposed by one of its lenders.

The following data is relevant:

The company now requires $800 million additional funding for a major expansion programme.

Which of the following is the most appropriate as a source of finance for this expansion programme?

ZZZ is a listed company based in Brinland. a European country. It is the largest owner and operator of residential care homes for elderly people in Brinland

Most of the residential care homes in Brinland are run by small private operators, and the standards of cafe are extremely variable However. 22Z has developed a good reputation because its client service is considered to be extremely good even though its prices are higher than those of most of its competitors.

ZZZ has expanded rapidly in the last few years, partly by acquisition and partly by organic growth consequently, the company's share price now stands at a record high, and the dividend declared at the end of the most recent accounting period was 10% higher than the previous year's dividend.

The Brinland government has recently set up a regulatory body to monitor the residential care homes industry. The regulatory body is considering introducing a variety of regulations to improve the customer experience in the industry. Following a period of consultation and investigation, the regulatory body is expected to announce a range of new regulations in the near future.

The directors of ZZZ are concerned that the new regulations may adversely affect their company

Which THREE of the following new regulations are likely to have the greatest negative impact on ZZTs performance?

A company has a cash surplus which it wishes to distribute to shareholders by a share repurchase rather than paying a special dividend.

Which THREE of the following statements are correct?

A company has convertible bonds in issue.

The following debt is apply (31 December 20X0):

• Conversion ratio- 20 shares for each $130 bond.

• Current share price - $4 50

• Expected annual growth in share price - 5%

Advise the bond Holder at which date the convers on would be worthwhile?

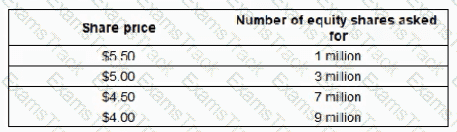

RST wishes to raise at least $40 million of new equity by issuing up to 10 million new equity shares at a minimum price of $3.00 under an offer for sale by tender. It receives the following tender offers:

What is the maximum amount that RST can raise by this share issue?

(Give your answer to the nearest $ million).

A company has two divisions.

A is the manufacturing division and supplies only to B, the retail division.

The Board of Directors has been approached by another company to acquire Division B as part of their retail expansion programme.

Division A will continue to supply to Division B as a retail customer as well as source and supply to other retail customers.

Which is the main risk faced by the company based on the above proposal?

The Board of Directors of a listed company wish to estimate a reasonable valuation of the entire share capital of the company in the event of a takeover bid.

The company's current profit before taxation is $4.0 million.

The rate of corporate tax is 25%.

The average P/E multiple of listed companies in the same industry is 8 times current earnings.

The P/E multiple of recent takeovers in the same industry have ranged from 9 times to 10 times current earnings.

The average P/E multiple of the top 100 companies on the stock market is 15 times current earnings.

Advise the Board of Directors which of the following is a reasonable estimate of a range of values of the entire share capital in the event of a bid being made for the whole company?

A company intends to sell one of its business units, Company R by a management buyout (MBO).

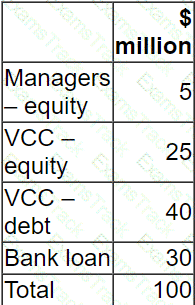

A selling price of $100 million has been agreed.

The managers are discussing with a bank and a venture capital company (VCC) the following financing proposal:

The VCC requires a minimum return on its equity investment in the MBO of 30% a year on a compound basis over 5 years.

What is the minimum TOTAL equity value of Company R in 5 years time in order to meet the VCC's required return?

Give your answer to one decimal place.

$ ? million

|

PDF + Testing Engine

|

|---|

|

$74.7 |

|

Testing Engine

|

|---|

|

$67.5 |

|

PDF (Q&A)

|

|---|

|

$59.7 |

CIMA Free Exams |

|---|

|