A large multi-divisional company in the food processing and distribution business is conducting a strategic review. The divisions all compete in the same market.

The sale of one of its underperforming food processing divisions to the divisional management team is currently being considered. The purchase by the divisional management team will require venture capital finance.

Which THREE of the following are likely to influence the multi-divisional company's decision on whether or not to sell the under-performing division to the management team?

Which of the following is NOT an advantage of a share repurchase?

A company is wholly equity funded. It has the following relevant data:

• Dividend just paid $4 million

• Dividend growth rate is constant at 5%

• The risk free rate is 4%

• The market premium is 7%

• The company's equity beta factor is 1.2

Calculate the value of the company using the Dividend Growth Model.

Give your answer in $ million to 2 decimal places.

$ ? million

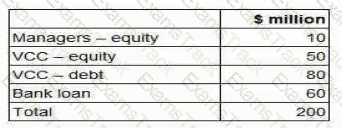

A company intends to sell one of its business units. Company W, by a management buyout (MBO). A selling price of S200 million has been agreed.

The managers are discussing with a bank and a venture capital company (VCC) the following financing proposal.

The VCC requires a minimum return on its equity investment In the MBO of 35% a year on a compound basis over 5 years. What is the minimum total equity value of Company W in 5 years time in order to meet the VCC's required return? Give your answer to one decimal place.

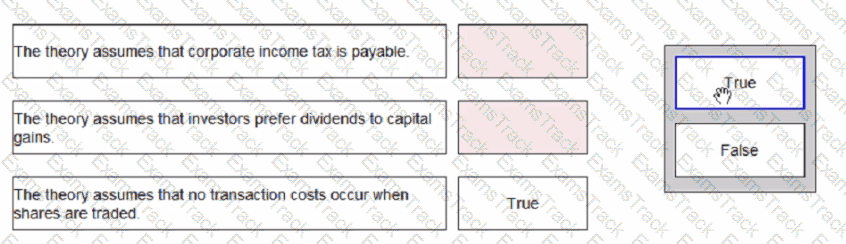

Select whether the following statements are true or false with regard to Modigliani and Miller's dividend policy theory.

An unlisted company:

Is owned by the original founder and member of their families.

Is growing more rapidly than other companies in the same industry.

Pays a fixed annual divided

Which of the following methods would be the most appropriate to value this company’s equity?

A company based in the USA has a substantial fixed rate borrowing at an interest rate of 3.5% and wishes to swap a part of this to a floating rate to take advantage of reducing interest rates Its bank has quoted swap rates of 3 4%-3 5% against 12-month USD risk-free rate.

What is the overall interest rate achieved by the company under this borrowing plus swap combination?

A wholly equity financed company has the following objectives:

1. Increase in profit before interest and tax by at least 10% per year.

2. Maintain a dividend payout ratio of 40% of earnings per year.

Relevant data:

• There are 2 million shares in issue.

• Profit before interest and tax in the last financial year was $4 million.

• The corporate income tax rate is 20%.

At the beginning of the current financial year, the company raised long term debt of $2 million at 5% interest each year.

Calculate the dividend per share that will be announced this year assuming the company achieves its objective of increasing profit before interest and tax by 10%.

Delta and Kappa both wish to borrow $50m.

Delta can borrow at a fixed rate of 12% or at a floating rate of the risk-free rate +3%

Kappa can borrow at 15% fixed or the risk-free rate +4%.

Delta wishes a variable rate loan and Kappa a fixed rate loan The bank for the two companies suggests a swap arrangement The two companies agree to a swap arrangement, sharing savings equally

What is the effective swap rate for each company?

Company X is an established, unquoted company which provides IT advisory services.

The company's results and cashflows are growing steadily and it has few direct competitors due to the very specialised nature of it's business. Dividends are predictable and paid annually.

Company P is looking to buy 30% of company X's equity shares.

Which TWO of the following methods are likely to be considered most suitable valuation methods for valuing company P's investment in Company X?

|

PDF + Testing Engine

|

|---|

|

$74.7 |

|

Testing Engine

|

|---|

|

$67.5 |

|

PDF (Q&A)

|

|---|

|

$59.7 |

CIMA Free Exams |

|---|

|