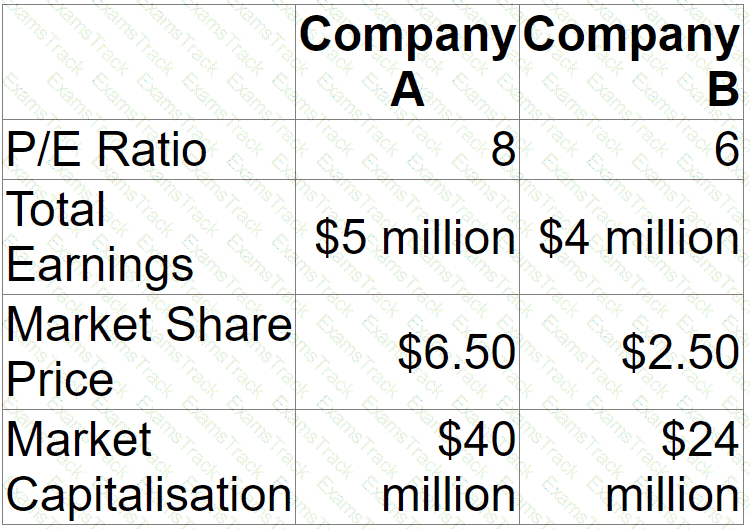

Company A is planning to acquire Company B.

Company A's managers think they can improve the performance of Company B to the extent that its own P/E ratio should be applied to Company B's earnings.

Relevant Data:

What is the expected synergy if the acquisition goes ahead?

Give your answer to the nearest $ million.

$ ? million

Company ADE is an unlisted company; it needs to raise a significant amount of finance to fund future expansion. The directors are considering listing the company on the local stock exchange The following discussions have taken place between some of the directors:

Director A - We consider a public issue of bonds in the capital markets, we don't need to list to issue the bonds which will save time and money.

Director B - We should list on the Alternative Investment Market (AIM) and not the main market to avoid any regulatory requirements

Director C - We should remain unlisted; we can access an unlimited amount of equity finance through a rights issue

Director D - Listing will increase Company ADE's ability to raise new equity and debt finance in the future.

Director E - If we list, Company ADE will be a more likely target for a takeover than if we remain unlisted.

Which TWO of the directors' statements are correct?

Company A is a listed company that produces pottery goods which it sells throughout Europe. The pottery is then delivered to a network of self employed artists who are contracted to paint the pottery in their own homes. Finished goods are distributed by network of sales agents.The directors of Company A are now considering acquiring one or more smaller companies by means of vertical integration to improve profit margins.

Advise the Board of Company A which of the following acquisitions is most likely to achieve the stated aim of vertical integration?

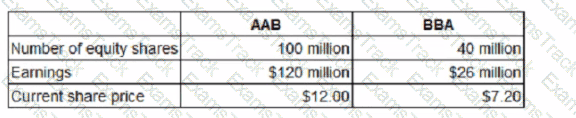

Company MB is in negotiations to acquire the entire share capital of Company BBA. Information about each company is as follows:

It is expected that Company BBA's profit before interest and tax will be $30 million in each of the two years after acquisition. Company AAB is considering how best to structure the offer Company AAB's discount factor and appropriate cost of equity for use in valuing Company BBA is 10%

Shareholders taxation implications should be ignored

Which of the following provides the shareholders of Company BBA with the highest offer price?

An unlisted software development company has recently reported disappointing results. This was partly due to weak economic conditions but also because of its poor competitive position. The company has a number of exciting development opportunities which would enable it to achieve significant future growth. The company's growth potential has been hindered by its inability to secure sufficient new finance.

To enable the company raise new finance the Directors are considering working forwards an IPO in 10 years and accepting finance from a venture capitalist in order support in the intervening period.

The directors are keen to retain a controlling stake in the company and full representation on the board. They therefore require venture capitalists to provide funds as a mix of debt and equity and not soley equity finance.

Which THREE of the following are most likely to disrupt the directors' plans to use venture capital finance?

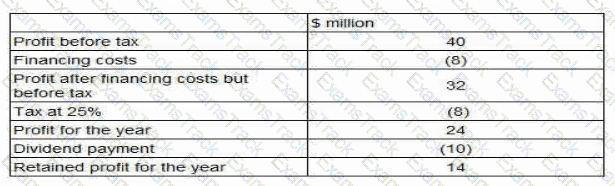

Company HJK is planning to bid for listed company BNM

Financial data for BNM for the financial year ended 31 December 20X1:

HJK is not forecasting any growth in these figures for the foreseeable future

Profit and cost data above should be assumed to be equivalent to cash flow data when answenng this question

Which THREE of the following approaches would be most appropriate for HJK to use to value the equity of BNM?

A company is considering hedging the interest rate risk on a 3-year floating rate borrowing linked to the 12-month risk-free rate.

If the 12-month risk-free rate for the next three years is 2%, 3% and 4%, which of the following alternatives would result in the lowest average finance cost for the company over the three years?

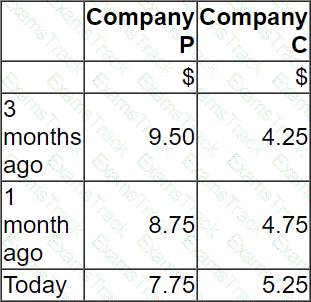

Company C has received an unwelcome takeover bid from Company P.

Company P is approximately twice the size of Company C based on market capitalisation.

Although the two companies have some common business interests, the main aim of the bid is diversification for Company P.

The offer from Company P is a share exchange of 2 shares in Company P for 3 shares in Company C.

There is a cash alternative of $5.50 for each Company C share.

Company C has substantial cash balances which the directors were planning to use to fund an acquisition.

These plans have not been announced to the market.

The following share price information is relevant. All prices are in $.

Which of the following would be the most appropriate action by Company C's directors following receipt of this hostile bid?

A listed company plans to raise new capital which will be required for future investment projects. The company has a gearing ratio of 50%, which is just below the company's target ratio.

The directors are comparing the benefits and drawbacks of each of the following two alternative sources of finance;

• Unsecured bank borrowings.

• Convertible bonds.

Which of the following statements is correct?

Company A is a large listed company, with a wide range of both institutional and private shareholders.

It is planning a takeover offer for Company B.

Company A has relatively low cash reserves and its gearing ratio of 40% is higher than most similar companies in its industry.

Which TWO of the following would be the most feasible ways of Company A structuring an offer for Company B?

|

PDF + Testing Engine

|

|---|

|

$74.7 |

|

Testing Engine

|

|---|

|

$67.5 |

|

PDF (Q&A)

|

|---|

|

$59.7 |

CIMA Free Exams |

|---|

|