The ex div share price of Company A’s shares is $.3.50

An investor in Company A currently holds 2,000 shares.

Company A plans to issue a script divided of 1 new shares for every 10 shares currently held.

After the scrip divided, what will be the total wealth of the shareholder?

Give your answer to the nearest whole $.

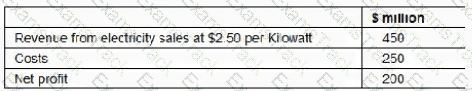

A company generates and distributes electricity and gas to households and businesses.

Forecast results for the next financial year are as follows:

The Industry Regulator has announced a new price cap of $2.00 per Kilowatt.

The company expects this to cause consumption to rise by 15% but costs would remained unaltered.

The price cap is expected to cause the company's net profit to fall to:

Which THREE of the following would be of most interest to lenders deciding whether to provide long-term debt to a company?

If a company's bonds are currently yielding 8% in the marketplace, why would the entity's cost of debt be lower than this?

Holding cash in excess of business requirements rather than returning the cash to shareholders is most likely to result in lower:

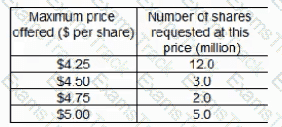

Company C invests heavily in Research and Development an need to raise $45 million to finance future projects. It has decided to use equity finance raised by a tender offer, The following tender offers have been received from potential investors:

Company C wishes to select an offer price that will project shareholders from a significant dilution of control but still raise the required amount of finance.

What offer price should Company C’s select?

Which THREE of the following remain unchanged over the life of a 10 year fixed rate bond?

ADC is planning to acquire DEF in order to benefit from the expertise of DEF's owner ‘managers Both are Listed companies. ADC is trying to decide whether to offer cash or shares in consideration for DEF's shares.

Which THREE of the following are advantages to ABC of offering shares to acquire CEF?

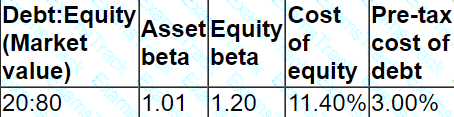

The following information relates to Company A's current capital structure:

Company A is considering a change in the capital structure that will increase gearing to 30:70 (Debt:Equity).

The risk -free rate is 3% and the return on the market portfolio is expected to be 10%.

The rate of corporate tax is 25%

Using the Capital Asset Pricing Model, calculate the cost of equity resulting from the proposed change to the capital structure.

PPA owns $500,000 of shares in Company ABB. Company ABB has a daily volatility of 2% of its share price

Calculate the 12-day value at risk that shows the most PPA can expect to lose during a 12-day period (PPA wishes to be 90% certain that the actual loss in any month will be less than your predicted figure)

Give your answer to the nearest thousand dollars.

|

PDF + Testing Engine

|

|---|

|

$74.7 |

|

Testing Engine

|

|---|

|

$67.5 |

|

PDF (Q&A)

|

|---|

|

$59.7 |

CIMA Free Exams |

|---|

|