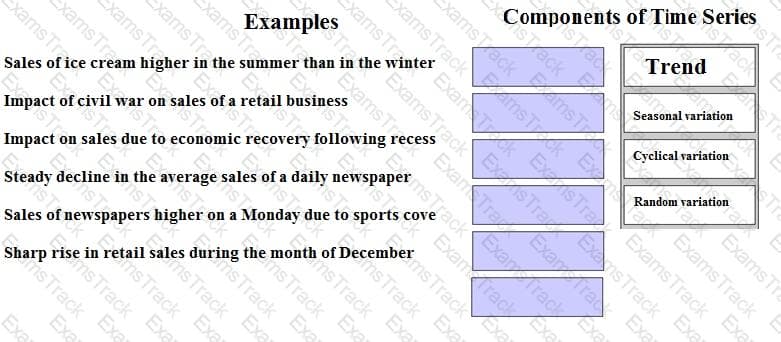

Place the components of the time series next to the example about the impact on sales that they best represent.

A company has a budgeted contribution to sales (C/S) ratio of 30% and a budgeted operating profit margin of 20%. Budgeted sales were $100,000.

In month 2, actual production and sales volumes and all costs were as budgeted. The actual C/S ratio was 33% .

Which of the following statements, about the company's contribution and operating profit in month 2, is correct?

A musical instrument manufacturing company is considering a new project that will require 1000 kg of wood. They have 700 kgs of wood in stock which was purchased last year for £4 per kg. The wood in stock can be

sold back to the supplier for £5 per kg. The wood in stock will have to be replaced if it is used. The current purchase price of wood is £8 per kg.

Using this information, what is the relevant cost of wood for the manufacturers decision on this project?

A pharmaceutical company manufactures pesticides which contain highly toxic chemicals.

In the context of environmental costing, which of the following would be classified as an external failure cost?

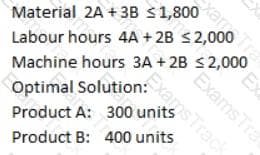

A company makes Product A and Product B. The production process for both products uses one type of material, one type of labour, and utilises one machine. All three of these resources will be limited in November. The company has performed a linear programming model and the constraints and optimal solution, to maximise contribution, are as follows:

Constraints:

For November, which of the above constraints are binding, and which are non-binding?

A company is considering the use of Material V in a special order.

The material is used regularly and a sufficient quantity of the material is in inventory.

It could also be sold, at just below the current market price, to a local competitor.

What is the relevant cost of Material V to be used in the special contract?

When classifying quality costs, which of the following is NOT likely to be an appraisal cost?

Which costing method, used in just-in-time (JIT) production systems, attaches cost directly to output rather than following the flow of product through the production process?

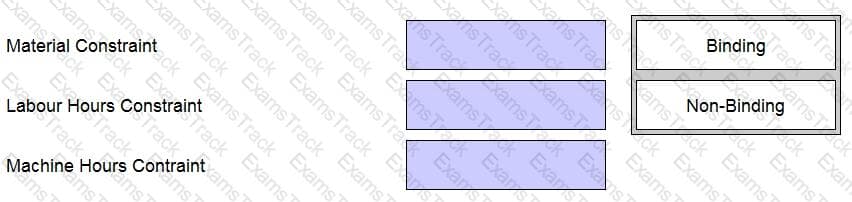

A company's budgeted data for the period are shown in the table below.

There is a stepped increase in fixed overheads of $10,000 when production exceeds 52,000 units.

Actual production for the period was 60,000 units.

What is the flexed budgeted cost for the period?

Give your answer as a whole number (in '000s).

The labour requirement for a special contract is 250 skilled labour hours paid at $10 per hour and 750 semi-skilled labour hours paid at $8 per hour.

At present, skilled labour is fully utilised on other contracts which generate a $12 contribution per hour, after charging labour costs. Additional skilled labour is unavailable in the short term.

There is a surplus of 1,200 semi-skilled hours over the period of the contract but the firm has a policy of no redundancies.

The relevant cost of labour for the special contract is:

|

PDF + Testing Engine

|

|---|

|

$87.15 |

|

Testing Engine

|

|---|

|

$78.75 |

|

PDF (Q&A)

|

|---|

|

$69.65 |

CIMA Free Exams |

|---|

|