What is the dividend yield of a stock that pays annual dividends of $4 per share and has a current market price of $80?

A building owner is undertaking a weatherization project. The owner will make a one-time investment of $410,000 for caulking, sunshades, and smart thermostats. Annual utility savings are projected to be:

Year 1: $125,000

Year 2: $125,000

Year 3: $140,000

Year 4: $140,000

Year 5: $160,000

What is thepayback period, in years?(Round up)

Which ratio measures a company’s ability to convert its receivables into cash?

What does a high inventory turnover ratio indicate about a company’s inventory management?

How does asset tangibility affect a company’s capital structure?

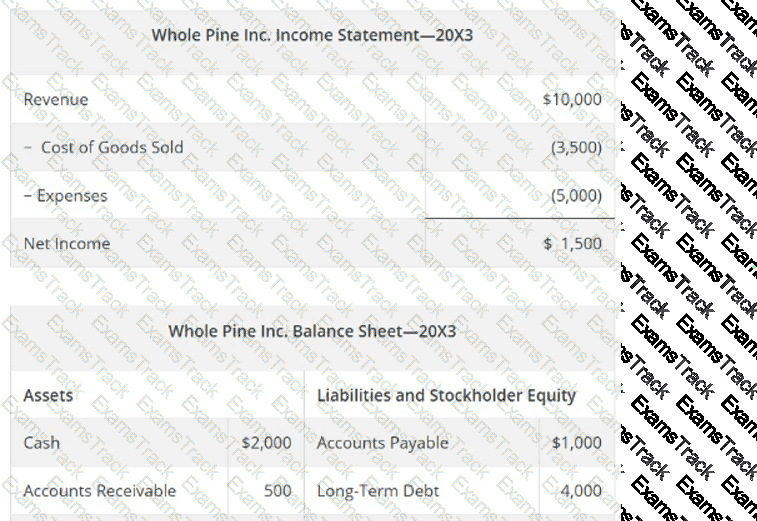

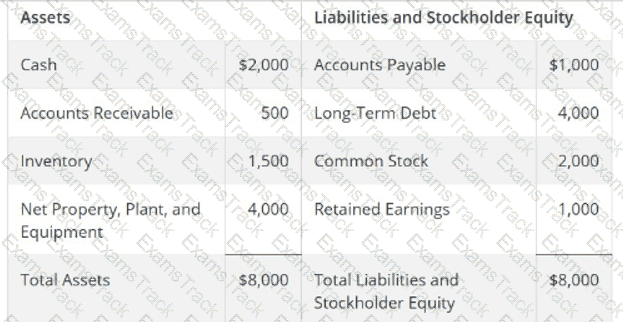

Use Whole Pine Inc.’s financial statements for 20X3 below to answer the following question.

What is Whole Pine Inc.’squick ratiofor 20X3?

What is a primary goal of managing accounts receivable through credit policies?

|

PDF + Testing Engine

|

|---|

|

$57.75 |

|

Testing Engine

|

|---|

|

$43.75 |

|

PDF (Q&A)

|

|---|

|

$36.75 |

WGU Free Exams |

|---|

|