U+ Bank wants to use Pega Customer Decision Hub™ to display a credit card offer, the Standard Card, to every customer who logs in to the bank website. What three of the following artifacts are mandatory to implement this requirement7 (Choose Three)

MyCo, a telecom company, developed a new data plan group to suit the needs of its customers. The following table lists the three data plan actions and the criteria that customers must satisfy to qualify for the offer:

U+ Bank wants to offer a Gold credit card to customers who have an annual income of more than USD150000. What do you configure in the Next-Best-Action Designer to achieve this outcome7

U+ Bank implemented a customer journey for its customers. The journey consists of three stages. The first stage raises awareness about available products, the second stage presents available offers, and in the last stage, customers can talk to an advisor to get a personalized quote. The bank wants to actively increase offers promotion over time.

What action does the bank need to take to achieve this business requirement?

U+ Bank, a retail bank, is designing an engagement policy for its credit card promotions. To meet legal requirements, the bank must ensure that only customers aged 18 or older are considered for any credit card offer.

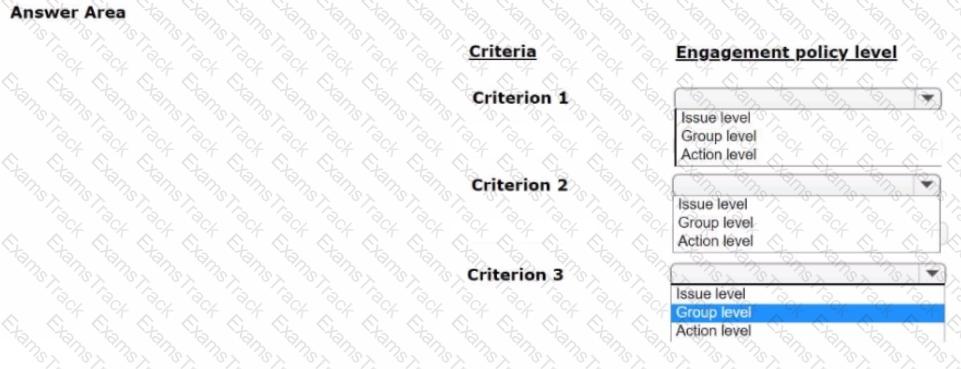

Which policy configuration level should U+ Bank use to implement the age requirement (18+ years) for all credit card promotions?

As a decisioning architect, how can you optimize the strategies that are based on Insights that you gain from the AI Insight feature in the Customer Profile Viewer?

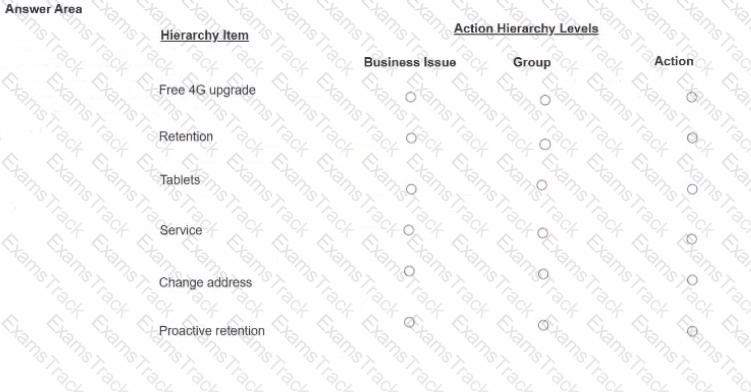

As a decisioning architect, you are setting up the action hierarchy for MyCo. Select the correct action hierarchy level for each of the hierarchy items identified.

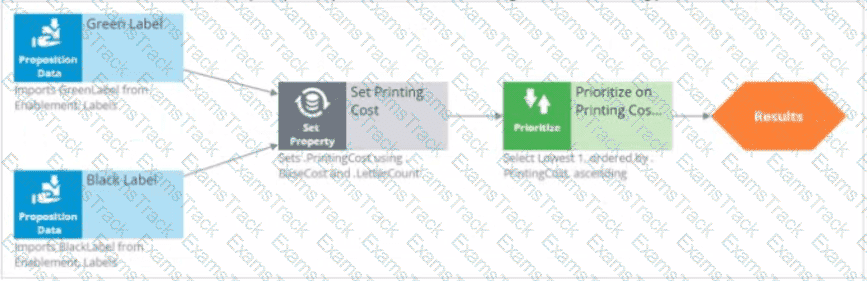

As shown in the following figure, decision strategy contains 'Green Label' and 'Black Label' Proposition components that point to the "Set Printing Cost' Set Property component that uses 'BaseCost' and "LetterCount." The configuration of the Prioritize component selects the lowest cost. What is the role of the Set Property component in the following decision strategy?

U+ Bank, a retail bank, uses the business operations environment to perform its business changes. The bank completes these changes by using revision management features of Pega Customer Decision Hub™ and 1:1 Operations Manager.

Customers see credit card offers based on various engagement policies on the U+ Bank website. The bank wants to update the underlying decision strategy of

an engagement policy condition.

According to best practices, which statement correctly describes the implementation of the change to fulfill this business requirement?

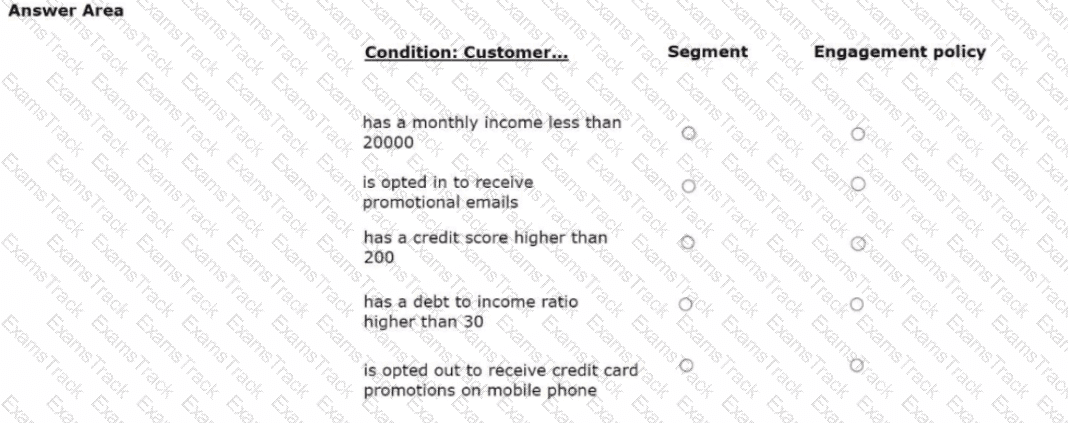

U+ Bank's marketing department wants to use the always-on outbound approach to send promotional emails about credit card offers to qualified customers. As a part of this promotion, the bank wants to identify the starting population by defining a few high-level criteria in a segment.

For each condition below, select which two conditions should be defined in Segment and which three conditions should be defined in Engagement policy as best practice.

|

PDF + Testing Engine

|

|---|

|

$57.75 |

|

Testing Engine

|

|---|

|

$43.75 |

|

PDF (Q&A)

|

|---|

|

$36.75 |

Pegasystems Free Exams |

|---|

|