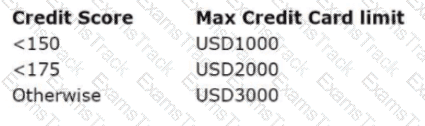

l)+ Bank uses Pega Customer Decision Hub™ to approve credit card limit changes requested by customers automatically. A scorecard model determines the customer credit score. The automatic approval of credit card limits are processed based on the following criteria set by the bank.

The bank wants to change the threshold value for the USD2000 credit limit from <175 to <200. How do you implement this change?

A bank has been running traditional marketing campaigns for many years. One such campaign sends an offer email to qualified customers on day one. On day five, the bank presents a similar offer if the first email is ignored.

If you re-implement this requirement by using the always-on outbound customer engagement paradigm, how do you approach this scenario?

Acme Retail uses Pega Customer Decision Hub™ to present various offers to its customers. The company notices that some high-value customers are not receiving any offers. The marketing team wants to identify these underserved customers.

Which tool in Pega Customer Decision Hub can Acme Retail use to identify segments of customers who are not receiving relevant offers?

Myco Bank, a retail bank, uses the Customer Engagement Blueprint to design personalized customer journeys. The bank wants to better understand its diverse customer base to create more targeted engagement strategies.

What key achievement does the Personas stage provide for Myco Bank when implementing with Customer Engagement Blueprint?

U+ Bank presents various credit card offers to its customers on its website. The bank uses AI to prioritize the offers according to customer behavior. With the introduction of the Gold credit card offer, the offer click-through propensity decreased to 0.42.

What does the decrease in the propensity value most likely indicate?

MyCo,a telecom company, recently introduced a new mobile handset offer, MyFone 14 Pro, for its premium customers. As the bank has financial targets to meet, the business decides to boost the MyFone 14 Pro offer.

As a decisioning architect, how can you ensure that the MyFonel4 Pro offer is prioritized over other offers7

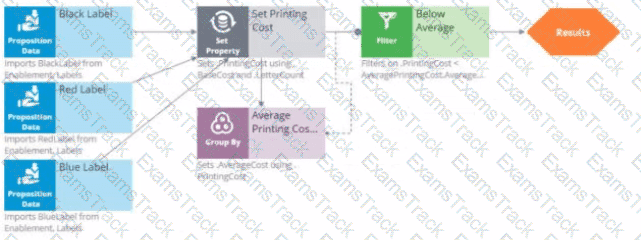

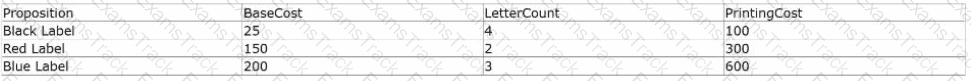

As a decisioning architect, you have built a decision strategy that selects actions that are below the average printing cost. The decision strategy contains 'Black Label', 'Red Label,' and 'Blue Label" Proposition components. The printing cost of the Proposition components are calculated based on the 'BaseCost' and 'LetterCount*.

The details of the proposition components are provided in the following table:

Which propositions does the strategy output?

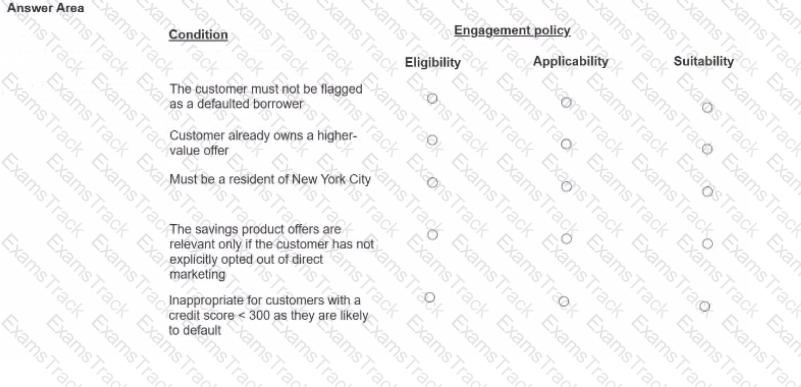

U+ Bank, a retail bank, has recently implemented a project in which credit card offers are presented to qualified customers when they log in to the web self-service portal The Dank added engagement policy conditions to show the offers based on the bank's requirements.

In the Answer Area, select the correct engagement policy for each condition.

MyCo, a telecom company, recently introduced a new mobile handset offer, MyFone 14 Pro, for its premium customers. As the bank has financial targets to meet, the business decides to boost the MyFone 14 Pro offer.

As a decisioning architect, how can you ensure that the MyFone 14 Pro offer is prioritized over other offers?

MyCo, a telecom company, notices that when customers call to check on bill status, 80% of the time, they received the wrong offer promotion, leading to customer dissatisfaction. The company decides to boost customers' needs in the prioritization formula, to Improve sales in the current quarter.

Which arbitration factor do you configure to implement the requirement?

|

PDF + Testing Engine

|

|---|

|

$57.75 |

|

Testing Engine

|

|---|

|

$43.75 |

|

PDF (Q&A)

|

|---|

|

$36.75 |

Pegasystems Free Exams |

|---|

|