U+ Bank, a retail bank, has purchased Pega Customer Decision Hub. The bank currently uses an external tool to design email content and a third-party email service provider to send emails to its customers.

As a decisioning architect, how do you recommend the bank implements this requirement?

A revision manager needs to deploy changes from the business operations environment to production. The NBA Specialist has completed all build tasks and validated the generated artifacts. The team lead has promoted the change request to the revision manager for deployment processing.

Which step should you take to push the changes to production?

U+ Bank's marketing department currently promotes various home loan offers to qualified customers. Now, the bank does not want to show offers on a customer's account page if the customer has already received three home loan offers in the last two weeks.

What do you need to define to implement the business requirement?

U+ Bank wants to send promotional emails related to credit card offers to their qualified customers. The business intends to use the same action flow template with the desired flow pattern for all the credit card actions.

What do you configure to implement this requirement?

As a Customer Service Representative, you present an offer to a customer who called to learn more about a new product. The customer rejects the offer. What is the next step that Pega Customer Decision Hub takes?

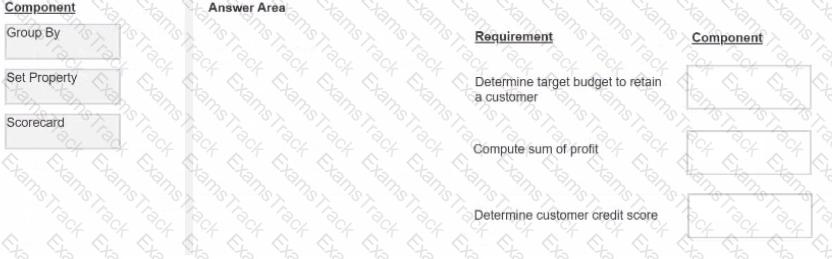

You are a decisioning architect on a next-best-action project and are responsible for designing and implementing decision strategies. Select each component on the leftand drag it to the correct requirement on the right.

A mortgage company defines a new suppression policy to limit promotional emails for home loan offers. The policy is complete, but it must be applied to all to home loan actions. The implementation team must associate this policy with the appropriate business structure.

Where should the team associate the contact policy to apply it to home loan promotions?

What is the name of the property that the system computes automatically when you use an Adaptive Model decision component?

U+- Bank uses Pega Customer Decision Hub'" for their one-to-one customer engagement. The bank now wants to change its offer prioritization to consider both business objectives and customer needs.

Which two factors do you configure in the Next-Best-Action Designer to implement this change? (Choose Two)

An NBA Specialist Is configuring the engagement policy for a new loan offer and wants to validate the policy. What is the best way for the NBA Specialist to validate the engagement policy?

|

PDF + Testing Engine

|

|---|

|

$57.75 |

|

Testing Engine

|

|---|

|

$43.75 |

|

PDF (Q&A)

|

|---|

|

$36.75 |

Pegasystems Free Exams |

|---|

|