Which factor is most important to consider when selecting a principal protected note (PPN)?

What type of risk is the fundamental risk factor for fixed-income securities?

Marc asks his new client for copies of his mortgage documents. Which Know Your Client component is Marc researching?

What stage in the business cycle typically has increasing wages, rising inflation, rising interest rates with slowing sales, and decreasing business investment?

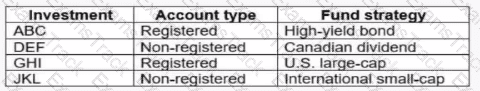

Matthew is planning on making the following investments in December:

Assuming all four investments have performed well throughout the year, which investment will trigger the highest unexpected taxes?

One of your clients, Sheldon, is 65 years old. He has $30,000 to invest. He has a low risk profile, and an investment objective of receiving regular income. He has a time horizon of 5 years.

Based on Sheldon's risk profile and investment objective, which of the following investment recommendations is MOST appropriate for Sheldon?

Greg, one of your clients, has been advised by a friend to invest in open-end mutual funds. He is not sure about the differences between open and closed-end funds.

What would you tell Greg about open-end funds?

Zara buys a future contract with an underlying value of $100,000 worth of stocks. She is required to deposit $1,750 of margin. Two weeks later, the underlying value of the stocks is $101,900. What is Zara's total return?

What term refers to the minimum rate at which the Bank of Canada lends money on a short-term basis to chartered banks?

Charlotte has received proceeds from a deceased family member’s estate. Charlotte decides to visit Malik, who’s a Dealing Representative at her bank. She tells Malik, she does not know much about trading ETFs, but she wants to invest in ETFs. Charlotte says she feels fortunate to have this money and that she’s not worried about losing it because she never planned on having any of it.

What element of the Know Your Client (KYC) information has Malik been able to learn?

|

PDF + Testing Engine

|

|---|

|

$49.5 |

|

Testing Engine

|

|---|

|

$37.5 |

|

PDF (Q&A)

|

|---|

|

$31.5 |

CSI Free Exams |

|---|

|