Which of the following form part of the disclosure documents relating to mutual funds?

What value are withdrawals under a ratio withdrawal plan based upon?

An increase in which factor may cause interest rates to decrease?

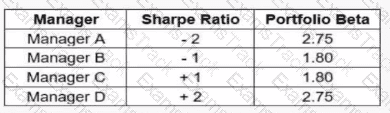

The following chart outlines data for various fund managers:

Which manager likely has the highest return for a given level of risk?

Your client, Cosmo, recently inherited $50,000 from his uncle. He wants to use this money towards his retirement savings. Cosmo is a 50-year old, self-employed carpenter and he earns on average $65,000

per year. He has a registered retirement savings plan (RRSP) with the bank worth $425,000 and a tax-free savings account (TFSA) worth $46,000. He started saving when he was 25 years old and has always

made his own investment decisions. His money is mostly invested in balanced funds. He feels most comfortable with these types of mutual funds since they offer potential investment growth but without being too aggressive. Cosmo has no other assets.

What additional information do you need about Cosmo to fulfill your know your client obligation?

What information does Fund Facts provide to potential investors?

Your client Jerry's asset mix is deviating from the original target asset mix because the stock market has had strong performance. Equities are now over-weighted in Jerry's account. The original target asset mix is still valid since Jerry's situation has not changed. He is invested in several bond and equity mutual funds. What should you do?

An established securities house in Quebec offers several investment products, including mutual funds and various securities (e.g., bonds and stocks). An administrative employee has brought forward a potential fund trading violation by a registered employee. Immediately following the employee's report what action is most likely to occur?

Recently interest rates have gone up. Your customer, Mr. Corelli, has asked you how this will affect the value of his mortgage fund. What is the best response to give to Mr. Corelli?

|

PDF + Testing Engine

|

|---|

|

$49.5 |

|

Testing Engine

|

|---|

|

$37.5 |

|

PDF (Q&A)

|

|---|

|

$31.5 |

CSI Free Exams |

|---|

|