What is the portion of a retiring allowance eligible to be transferred into a Registered Retirement Savings Plan (RRSP) or a registered pension plan (RPP) tax free based on?

Michael is an employee in Alberta who is paid bi-weekly and earns $1,600.00 per pay period. He has a taxable meal allowance of $30.00 per pay period. His federal and provincial TD1s on file show a claim code 2. Michael already reached the annual maximum first and second Canada Pension Plan (CPP) contributions before this pay. Calculate his total federal and provincial income taxes.

The Canada Revenue Agency form that is completed to allow a commissioned employee to claim non-reimbursed expenses at source is a:

Duncan Drapak was employed in Ontario. Upon termination of his employment, he will be paid $7,760.00 legislated wages in lieu of notice together with his final weekly pay of $875.00. Calculate Duncan’s Canada Pension Plan (CPP) contribution if the yearly maximum contribution will not be exceeded.

PF1 Exam – Net Pay Calculation (Template Worksheet)

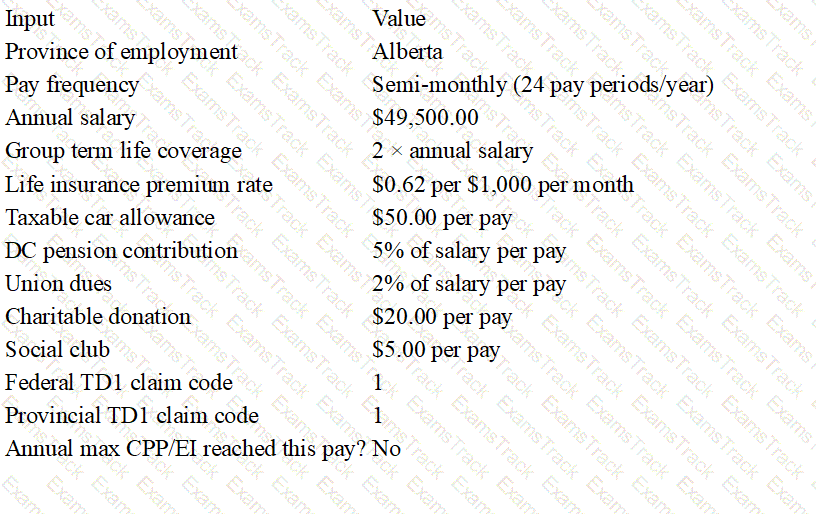

Scenario

Diane Lemay works for Monarch Construction in Alberta and earns an annual salary of $49,500.00, paid on a semi-monthly basis.

The company provides its employees with group term life insurance coverage of two times annual salary and pays a monthly premium of $0.62 per $1,000.00 of coverage.

Diane uses her car to meet with clients on company business and receives a taxable car allowance of $50.00 per pay.

The company has a defined contribution pension plan to which Diane contributes 5% of her salary each pay.

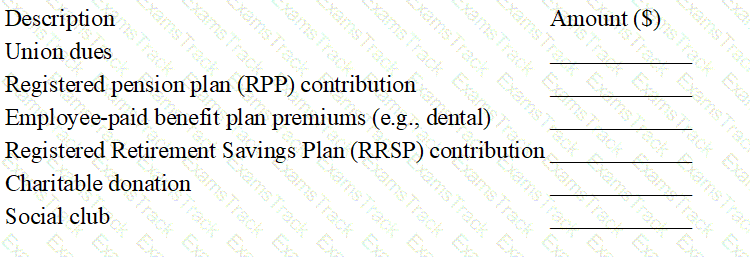

Diane also contributes $20.00 to United Way and has $5.00 deducted for her social club membership each pay. She belongs to a union and pays 2% of her salary in union dues per pay period.

Diane’s federal and provincial TD1 claim codes are 1. She will not reach the first Canada Pension Plan or Employment Insurance annual maximums this pay period.

Required: Calculate the employee’s net pay, following the order of the steps in the net pay template.

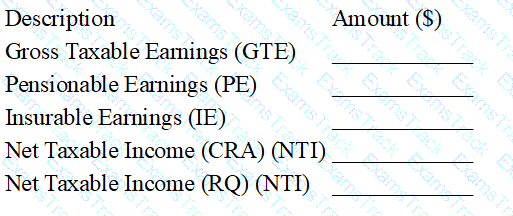

EXHIBIT A — Net Pay Template (Fill in all blanks)

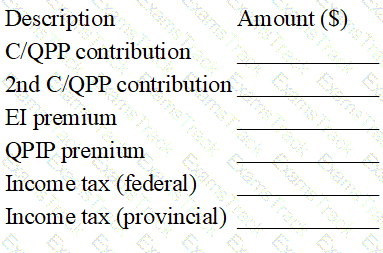

STATUTORY DEDUCTIONS

OTHER DEDUCTIONS

Given Data (Reference)

Step 1 — Calculate the employee’s gross taxable earnings (GTE) for this pay.

[ _________________________________ ]

Step 2 — Calculate the pensionable earnings (PE).

[ _________________________________ ]

Step 3 — Calculate the insurable earnings (IE).

[ _________________________________ ]

Step 4 — Calculate the net taxable income (CRA) (NTI).

[ _________________________________ ]

Step 5 — Calculate the net taxable income (RQ) (NTI).

[ _________________________________ ]

Step 6 — Calculate Diane’s Canada Pension Plan contribution.

[ _________________________________ ]

Step 7 — Calculate Diane’s Employment Insurance premium.

[ _________________________________ ]

Step 8 — Calculate Diane’s Quebec Parental Insurance Plan premium.

[ _________________________________ ]

Step 9 — Determine Diane’s federal income tax.

[ _________________________________ ]

Step 10 — Determine Diane’s provincial income tax.

[ _________________________________ ]

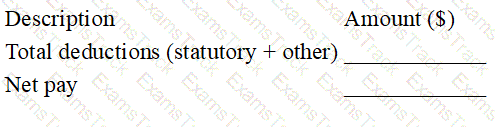

Step 11 — Calculate Diane’s total deductions (statutory + other).

[ _________________________________ ]

Step 12 — Calculate Diane’s net pay.

[ _________________________________ ]

Helen is reimbursed for the cost of the protective clothing that is legally required for her job. The clothing she bought isnot supported by receiptsand is a reasonable reimbursement amount. This is considered:

Bonus and incentive pays are subject to which statutory deductions?

The authorization for hiring form should contain a checklist to ensure the organization obtains all required information. What is an example of an item that could be on that checklist?

Which of the following types of payments made by a private organization would not be subject to all statutory deductions?

An employee–employer relationship is deemed to exist when:

|

PDF + Testing Engine

|

|---|

|

$49.5 |

|

Testing Engine

|

|---|

|

$37.5 |

|

PDF (Q&A)

|

|---|

|

$31.5 |

National Payroll Institute Free Exams |

|---|

|