What are two recommended best practices with user interface (UI) mock-ups in a ClaimCenter implementation project? (Choose two.)

Succeed Insurance is implementing a slightly modified version of ClaimCenter to suit its organization's needs. The modification will include adding two new required fields to the standard user interface to capture the reporter's Preferred Language and Preferred Contact Time. This requirement is critical for Succeed to improve efficiency and the expediency of claims processing in its region.

Under which ClaimCenter theme will the User Story Card be found for documenting these requirements?

A sales executive and business traveler has a full coverage auto policy through his insurance company. The executive lives in Detroit, Michigan and often drives across the border to visit client offices in Canada.

While driving in downtown Toronto, the executive's car was hit by a truck coming the wrong way. He called his insurance company to report a claim for this accident. However, the Customer Service Representative (CSR) cannot confirm there is an active policy on file.

How should this claim be handled?

Succeed Insurance has a strategic initiative to offer pay-as-you-drive personal auto insurance to compete with other large carriers. Customers who choose these policies

must either own a vehicle that is equipped with a monitoring device or agree to install a device provided by Succeed. The monitoring device collects information about how

the drivers of a covered vehicle drive, including how fast they drive, how hard they brake, and how many miles/kilometers the vehicle travels within a policy period.

This information is logged, and premiums are based on how the insured's driving behavior is categorized. When a claim is reported, the log files must be obtained in order to

analyze the information captured by the monitoring device at the time of the incident.

Succeed plans to collect and evaluate the Vehicle Monitoring Log files in the first implementation phase, which is scheduled for release in 60 days. The project sponsors

have instructed the implementation team to use base product functionality over customization. Integration should be leveraged where possible to avoid manual data entry.

The New Claim Wizard must capture whether or not the vehicle has a monitoring device installed when a personal auto claim is created against a pay-as-you-drive policy.

Which feature of the base product enforces this claim creation requirement?

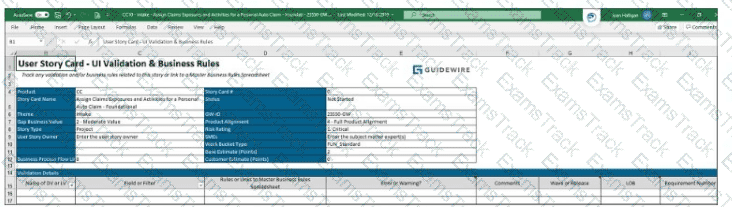

At Succeed Insurance, new personal auto claims involving a fatality are assigned to a High Complexity Auto group made up of Adjusters with at least eight years of experience dealing with the issues and emotions commonly found in claims involving fatalities. Fatality claims typically take 18 to 24 days to complete. The assigned Business Analyst (BA) will document the assignment rule for this requirement in User Story Card Assign Claims Exposures and Activities for a Personal Auto Claim - Foundational. The existing tab UI Validation & Business Rules shown below is not a good fit for assignment rules, so a new tab will be added to the Story Card.

Which two sets of columns should the new tab include to accurately capture the assignment rule requirements? (Choose two.)

To help manage new user setup, Succeed Insurance would like all manager-level employees to be able to add new users to ClaimCenter. Some managers are already assigned the Community Admin role, which has a set of permissions for the administration of the ClaimCenter community model that includes the permission to create new users.

Where are two places the Business Analyst (BA) can go to view the permissions assigned to manager-level users? (Choose two.)

Which two components are necessary to create the check(s) using the wizard? (Choose two.)

A catastrophe has been created in ClaimCenter for Tropic Storm Dorian. Succeed Insurance requires that all claims resulting from the storm be attributed to that catastrophe when they are entered in ClaimCenter. The completion target is within three (3) days of claim creation and should be escalated if it is not completed within five (5) days.

Which required element for a business activity rule is missing?

Drivers for Rideshare companies need insurance that provides protection when they are driving the vehicle for personal reasons. This will be the Succeed Insurance standard Personal Auto Policy. However, they also need insurance to protect them from the increased risks associated with working as a Rideshare Driver. This would include when they are logged in to the Rideshare application waiting for a customer match, on their way to pick up a customer, but not when a customer has entered the vehicle.

When a driver is working as a Rideshare Driver, this new Rideshare coverage will protect them from the following types of risks, and there is a need to be able to collect the appropriate information about the losses:

. Injury to a first-party driver

. Damaged personal property of the third-party passengers

Which two exposures need to be configured? (Choose two.)

A car accident in a rural area of Durango, Colorado is reported to Succeed Insurance. The driver of the damaged car reportedly hit the base of a windmill tower while driving at night. There was no other passenger in the car when the accident happened, and the driver has a valid auto policy on file.

While the driver is not physically injured, the entire passenger side of the car has been severely damaged. Although the windmill is still functioning, the base of the tower has sustained multiple broken parts.

Which two incidents need to be created for the claim based on the reported accident? (Choose two.)

|

PDF + Testing Engine

|

|---|

|

$57.75 |

|

Testing Engine

|

|---|

|

$43.75 |

|

PDF (Q&A)

|

|---|

|

$36.75 |